Comprehending the Benefits of Medicare Supplement in Insurance Policy

Navigating the complex landscape of insurance policy options can be a daunting job, especially for those coming close to old age or currently registered in Medicare. Amidst the variety of choices, Medicare Supplement prepares stand out as a beneficial resource that can supply peace of mind and monetary protection. By understanding the advantages that these strategies provide, people can make enlightened decisions regarding their medical care coverage and make sure that their demands are sufficiently fulfilled.

Importance of Medicare Supplement Program

When thinking about medical care insurance coverage for retired life, the relevance of Medicare Supplement Program can not be overemphasized. Medicare Supplement Program, additionally recognized as Medigap plans, are made to load in the voids left by typical Medicare insurance coverage.

One of the essential advantages of Medicare Supplement Plans is the comfort they provide by offering extra financial protection. By paying a monthly costs, people can much better budget plan for health care expenses and avoid unexpected clinical expenditures. Moreover, these plans frequently offer coverage for medical care solutions got outside the United States, which is not supplied by initial Medicare.

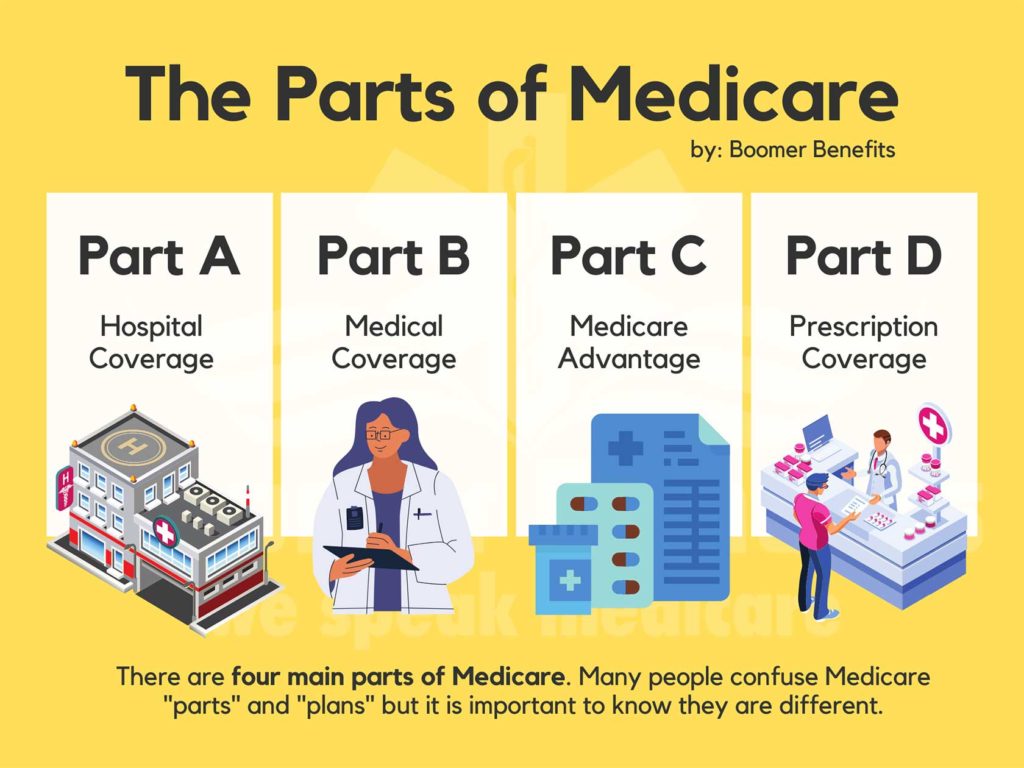

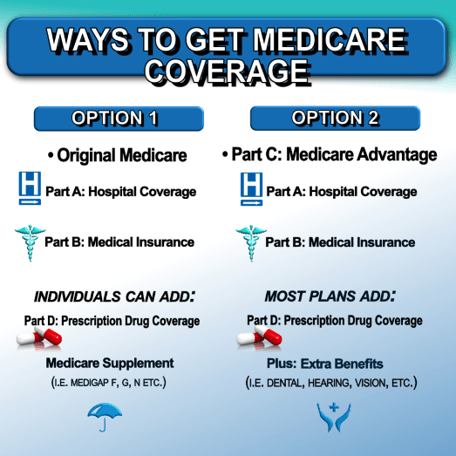

Coverage Gaps Resolved by Medigap

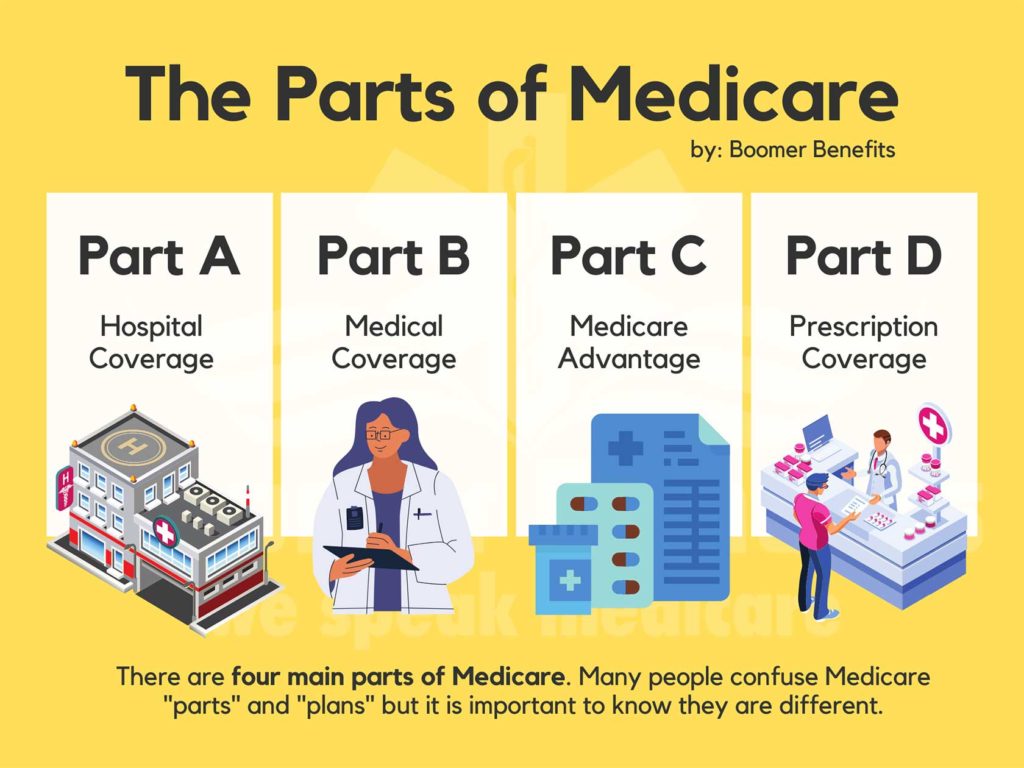

Attending to the spaces in coverage left by standard Medicare, Medicare Supplement Plans, also called Medigap policies, play an essential duty in offering comprehensive medical care protection for people in retired life. While Medicare Part A and Component B cover many health care expenses, they do not cover all prices, leaving beneficiaries at risk to out-of-pocket costs. Medigap strategies are developed to load these protection spaces by spending for specific medical care costs that Medicare does not cover, such as copayments, coinsurance, and deductibles.

By supplementing Medicare insurance coverage, people can much better manage their health care costs and avoid unexpected financial burdens related to clinical treatment. Medigap policies provide flexibility in choosing healthcare providers, as they are generally approved by any type of health care company that accepts Medicare assignment.

Price Financial Savings With Medigap Policies

With Medigap policies successfully covering the gaps in typical Medicare, one significant advantage is the capacity for significant expense savings for Medicare beneficiaries. These plans can assist lower out-of-pocket costs such as copayments, coinsurance, and deductibles that are not totally covered by original Medicare. By completing these monetary openings, Medigap plans deal beneficiaries monetary assurance by limiting their total healthcare expenses.

Moreover, Medigap policies can give predictability in healthcare costs. With fixed regular monthly costs, recipients can budget plan better, understanding that their out-of-pocket prices are more controlled and regular. This predictability can be specifically useful for those on dealt with incomes or tight budget plans.

Adaptability and Freedom of Option

One of the essential benefits of Medicare Supplement Insurance Coverage, or Medigap, is the adaptability it supplies in picking healthcare companies. Unlike some handled care strategies that restrict individuals to a network of doctors and healthcare facilities, Medigap plans generally allow recipients to go to any healthcare service provider that accepts Medicare.

In significance, the versatility and freedom of selection managed by Medigap policies enable recipients to take control of their health care decisions and tailor their helpful hints medical care to satisfy their individual requirements and choices.

Increasing Appeal Amongst Senior Citizens

The rise in appeal amongst elders for Medicare Supplement Insurance Coverage, or Medigap, highlights the growing recognition of its advantages in boosting medical care coverage. As elders navigate the complexities of healthcare options, numerous are transforming to Medicare Supplement intends to load the voids left by traditional Medicare. The assurance that comes with understanding that out-of-pocket expenses are lessened is a considerable factor driving the raised rate of interest in these policies.

Moreover, the adjustable nature of Medicare Supplement intends enables elders to tailor their protection to suit their specific health care demands. With a selection of strategy choices offered, senior citizens can choose the mix of advantages that ideal straightens with their health care requirements, making Medicare Supplement Insurance an appealing choice for many older grownups seeking to protect comprehensive coverage.

Final Thought

To conclude, Medicare Supplement Plans play a critical duty in resolving insurance coverage spaces and conserving prices for elders. Medigap plans provide flexibility and flexibility of choice for people looking you could check here for added insurance coverage - Medicare Supplement plans near me. Because of this, Medigap strategies have seen a surge in appeal amongst elders that value the advantages and comfort that include having extensive insurance protection

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!